Learn the history of the Bank, and read short biographies of past governors.

The time before our central bank

Before the Great Depression of the 1930s, the scattered and mainly rural population of Canada didn’t need a central bank. At that time, a small number of banks established branches in multiple communities, and it worked well.

Canada’s chartered banks provided most bank notes in circulation and met seasonal or unexpected demands. Larger banks dealt with government business without strain, and the branch network gradually developed a system for clearing cheques between banks.

Banking evolved differently in the United States. Its larger and more urban population encouraged the development of a large number of banks, each serving only one community.

Responding to changing needs

Then came the Great Depression.

The prolonged depressed economy, fuelled by drought conditions and a worldwide economic slump, contributed to a change in government and unprecedented public criticism of Canada's banking system. It also coincided with Prime Minister R.B. Bennett's concern that Canada lacked a direct means for settling international accounts.

In 1933, he set up a Royal Commission, headed by Lord Macmillan, to study “the organization and working of our entire banking and monetary system [and] to consider the arguments for or against a central banking institution.” The arguments “for” a central bank won. A week after the Royal Commission report recommended the establishment of a central bank, Prime Minister Bennett announced that his government would adopt the recommendations.

An appendix to the report, titled "Suggestions as to some of the Main Features of the Constitution of a Central Bank for Canada," became the framework for the Bank of Canada Act. The Act received royal assent on July 3, 1934. In March 1935, the Bank of Canada opened its doors as a privately owned institution with shares sold to the public. Soon after, a new government introduced an amendment to the Bank of Canada Act to nationalize the institution.

In 1938, the Bank became publicly owned and remains so today.

Establishing our functions

The first Governor of the Bank of Canada was Graham F. Towers. The 37-year-old Canadian had extensive international experience with the Royal Bank of Canada and had appeared before the Macmillan Commission on behalf of the chartered banks. He headed the Bank of Canada for 20 years and oversaw the integration of the central bank functions.

- The Department of Finance transferred responsibility for bank note operations to the newly established Bank of Canada.

- The offices of the Receiver General across the country became the agencies of the Bank.

- A new Research Division provided information and advice on financial developments and on general business conditions at home and abroad.

- The Foreign Exchange Division and the Securities Division became operative almost immediately, though the transfer of the Public Debt Division from the Department of Finance was delayed until suitable quarters were available. This did not occur until the completion of the Bank of Canada building at 234 Wellington Street in 1938.

The Bank of Canada building at 234 Wellington Street in Ottawa is located near some of the country’s most important institutions and landmarks, including the Parliament of Canada and the Supreme Court of Canada. Wellington Street is on the ceremonial and discovery route through downtown Ottawa and Gatineau called Confederation Boulevard.

Our head office is known for classical and modern architectural elements that honour history and embrace advancing technology. In the dignified rooms of the original stone-clad building and in the sunshine-flooded glass atrium, our staff enjoy the latest in accessibility, safety and functionality.

Our past governors

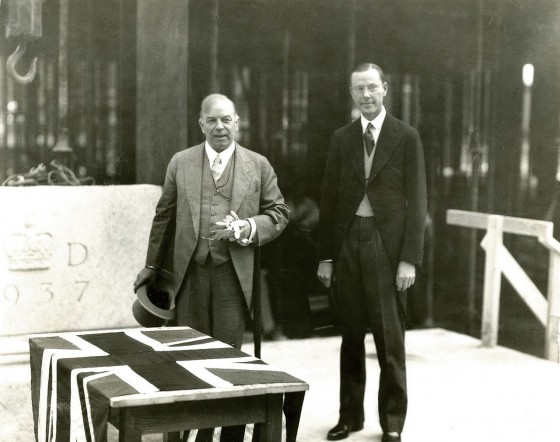

Historical photos on Flickr

A collection of official and amateur photographs in black and white and colour, which illustrate the architecture, organization, artwork, functions, and interests of the Bank of Canada.

Bank of Canada souvenir books

Access the Bank of Canada souvenir books, which examine various aspects of the Bank’s history.