Overview

In this note, we present the Bank of Canada’s 2025 staff assessment of potential output in Canada. The ongoing US trade conflict makes the outlook highly uncertain. This assessment provides two scenarios for potential output growth that correspond to different possible trade policy outcomes, consistent with the two scenarios used in the April 2025 Monetary Policy Report (see Assumptions for the outlook section).

Scenario 1 is characterized by:

- elevated trade policy uncertainty that starts to fade at the end of 2026

- limited US tariffs of 25% on Canadian steel and aluminum exports and the associated 25% on $29.8 billion of Canadian imports of US goods

Scenario 2 builds on Scenario 1 by adding:

- 25% US tariffs on Canadian and Mexican motor vehicles and parts

- 12% US tariffs on all other goods imported from Canada and Mexico

- 25% US tariffs on goods imported from all countries, excluding Canada and Mexico

In Scenario 2, Canada responds with a 12% tariff on $115 billion of imports of US final goods (excluding motor vehicles) and a 25% tariff on $40 billion of US motor vehicles.1

Between 2025 and 2028, annual growth of potential output averages 1.6% in Scenario 1 and 1.1% in Scenario 2. Compared with the April 2024 assessment, these figures imply an average revision to the growth rate of -0.1 percentage points in Scenario 1 and ‑0.8 percentage points in Scenario 2 over 2025–27 (Devakos et al. 2024). The level of potential output is revised up by 1.0% in 2024. Over 2025–27, the level is revised up by 0.9% on average in Scenario 1 and revised down by 0.5% in Scenario 2 (Table 1).

Table 1: Comparison of potential output estimates relative to April 2024

| Scenario 1 | Scenario 2 | |||

|---|---|---|---|---|

| Annual growth | Revisions to the level of potential output | Annual growth | Revisions to the level of potential output | |

| 2024 | 2.9 (2.5) | 1.0 | 2.9 (2.5) | 1.0 |

| 2025 | 1.8 (1.7) | 1.1 | 1.2 (1.7) | 0.5 |

| 2026 | 1.3 (1.5) | 0.9 | 0.4 (1.5) | -0.7 |

| 2027 | 1.4 (1.7) | 0.6 | 1.0 (1.7) | -1.3 |

| 2028 | 1.7 | - | 1.6 | - |

Note: Estimates of annual growth rates of potential output from the April 2024 assessment appear in parentheses.

Over the scenario horizon, potential output growth is weighed down by weak population growth as well as low confidence and heightened cautiousness stemming from:

- uncertainty around trade policy (Scenario 1)

- the impact of broad-based tariffs (Scenario 2)

Anticipated weak population growth in 2025–26 reflects the federal government’s 2024 announcement of reduced targets for immigration and restrictions for temporary residents.

The two scenarios are designed such that, when taken together, they encompass a range of trade policies and associated paths for potential output. We also consider upside and downside risks with a focus on population growth, widespread adoption of artificial intelligence (AI) and the indirect impacts of the US trade conflict.

Revisions to potential output

Revisions to the level

Positive revisions to gross domestic product (GDP) and business investment throughout 2024 lead to potential output being 1.0% higher in 2024 compared with the April 2024 assessment. Under scenario 1, this leads to potential output being 0.6% higher by the end of the scenario horizon.

Under Scenario 2, potential output is 1.3% lower by the end of 2028. This is because the adverse impacts of tariffs on productivity more than offset the positive historical revisions (Table 1, column 4). While the elevated uncertainty lowers potential output through reduced investment, broad-based tariffs have the additional effect of creating long-run inefficiencies from decreased trade and misallocation of resources (see Box 1).

Revisions to growth over history

Changes to potential output growth since the April 2024 assessment capture the new data for the national accounts and capital flows and stocks published by Statistics Canada. The national accounts updates include historical revisions to GDP and investment.

Together, these updates imply growth in trend total factor productivity (TFP) that is stronger than previously anticipated, resulting in positive revisions to potential output growth over 2021–24 (Chart 1, purple bars).2 These positive revisions over history are partially offset by data updates related to the labour market, such as weaker-than-expected employment, especially among younger cohorts. This results in lower estimates of trend labour input (TLI) from our cohort-based TLI model (Chart 1, blue bars).3 Overall, the revisions added an average of 0.2 percentage points to potential growth over 2021–24.

Chart 1: Potential output growth is revised down over 2025–27, largely due to trade impacts and population

Revisions to growth over the scenario horizon

In both scenarios, weaker anticipated population growth compared with the April 2024 assessment is one of the main reasons for the downward revisions to potential output growth over 2025–27. Overall, since last year’s assessment, we have revised down our outlook for growth in Canada’s working-age population (15 and older) by 0.2 percentage points on average for that same period.

Revisions to the population outlook reflect the balance of two opposing factors:

- The largest change affecting our population growth outlook is the reduction in the annual permanent resident target by more than 100,000 per year for 2025–27. This lowers total population growth by 0.3 percentage points per year.4

- Our forecast for flows of non-permanent residents (NPRs) is revised up slightly, contributing 0.1 percentage points to total population growth. Staff evaluated the impacts of the new measures announced by the federal government over the past year at the program level (see Box 2 for more details). This analysis suggests that net NPR flows over 2025–27 will likely be slightly higher than anticipated in April 2024.

The slowdown of population growth has a direct impact on TLI because it decreases the growth of the working-age population. In addition, the lower immigration targets weigh on TLI growth through trend employment because newcomers generally have higher trend employment rates than the population average (Champagne et al. 2023). At the same time, the decrease in TLI raises capital per hour worked, providing a partial positive offset to potential output through higher labour productivity growth. The net impact of these revisions on potential output is a decrease of 0.2 percentage points on average over 2025–27 (Chart 1, yellow bars).

US trade policy uncertainty is the other major source of revision to our outlook. The negative confidence effects stemming from trade policy uncertainty weigh on business investment and potential output growth. Broad-based tariffs, if permanent, would have a more pronounced impact on trend labour productivity (TLP). As a result, the revisions to potential output growth over 2025–27 are much larger under Scenario 2 than under Scenario 1.

- In Scenario 1, elevated trade policy uncertainty lowers business investment growth by 1.4 percentage points on average over 2025–26. This pulls down potential output growth modestly, by 0.1 percentage points on average over 2025–27 (Chart 1, bright green bars).

- In Scenario 2, uncertainty around future trade policy continues to weigh on investment. However, potential output growth is pulled down further because of long-run efficiency losses. These losses are from reduced trade and misallocation of resources with broad-based tariffs (refer to Box 1 for details). In this scenario, potential growth is 0.7 percentage points lower, on average, over the same period (Chart 1, dark green bars).

Note that all the revisions discussed above except for those associated with broad-based tariffs (Chart 1, dark green bars) are common to both scenarios.

Dynamics of potential output growth

After the sharp decline during the COVID-19 pandemic, potential output growth averaged 2.4% in 2021–22. Growth strengthened in 2023–24 as a result of robust population growth, which supported TLI.

However, potential output growth slows sharply through 2027 (Chart 2). Slower population growth explains most of this weakness through softer TLI growth (Chart 2, blue bars). TLP growth, in contrast, recovers somewhat over this period (Chart 2, lime green bars). However, this rebound is likely to be significantly weaker (i.e., Scenario 2, shown by the forest green bars in Chart 2) than it would be without broad-based tariffs.

Chart 2: Potential output growth decreases over the scenario horizon

Trend labour input

The contribution of TLI to potential output growth declines to 0.7 percentage points in 2025 and to 0.2 percentage points over 2026–27. This mainly reflects the anticipated slowdown in flows of newcomers, as discussed in the previous section. Specifically, we assume that working-age population growth will decline from the 2024 growth rate of 3.3% to 1.2% in 2025 and to 0.5% over 2026–27 (Chart 3, green bars). Despite this decline over the scenario horizon, population growth remains the largest factor behind TLI growth.

The trend employment rate and trend average hours worked have smaller impacts on TLI growth than population growth does. Following some strength in 2023, the contribution from the trend employment rate declined in 2024, reflecting recently weak employment, particularly among younger workers. The contribution of trend employment remains weak over the scenario horizon. This reflects an aging population, which has been the main reason for the gradual decline in trend employment rate in recent years.

Chart 3: Population growth is driving trend labour input growth

Trend labour productivity

TLP growth rate was negative over 2023–24 because strong population growth reduced capital per hour worked (Chart 2, lime green bars). Over 2025–27, TLP growth rebounds as population growth weakens, causing capital per hour work to rise.5 How quickly TLP growth recovers depends on how trade tensions evolve.

In Scenario 1, labour productivity is weighed down primarily by capital deepening and weaker investment (Chart 2, olive green bars). TLP growth picks up in 2025 and remain relatively stable over the scenario horizon. This is because the negative confidence effects on investment—which are frontloaded in 2025–26—are more than offset over this period by rising capital per hour worked associated with weaker population growth. As a result, TLP growth remains close to its longer-run trend over 2025–27.

In Scenario 2, with broad-based tariffs, TLP growth is much lower (Chart 2, forest green bars). This reflects both a sharper decline in investment and further productivity losses from the impacts of higher permanent tariffs on trend TFP growth (Box 1). In this scenario, TLP growth does not return to its longer-run trend until 2027.

Risks around the outlook

The outlook under the two scenarios is subject to several risks that we divide between ongoing structural factors and trade-related factors.

The ongoing structural risks are:

- population growth

- broad diffusion of generative AI

The trade-related risks, in contrast are:

- increased competitiveness of Canadian exporters

- loss of efficiency due to a lower volume of technology-embodied imports

- scarring labour market effects

When considered on their own, each risk has a relatively small impact. However, we focus on the most plausible risks. If all the downside risks or all the upside risks were to occur, they could contribute as much as -0.5 percentage points to +0.5 percentage points to potential output growth in any given year. Table 2 summarizes assessments of the potential magnitudes of each risk.

Table 2: The range for potential output is subject to additional risks

| Risk | Direction of risk | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Ongoing structural factors | |||||

| Population growth | Downside | -0.2 | -0.3 | -0.3 | -0.3 |

| Upside | 0.2 | 0.3 | 0.3 | 0.3 | |

| Adoption of artificial intelligence | Upside | 0.1 | 0.1 | 0.1 | 0.1 |

| Total structural factors (additive) | -0.2, 0.3 |

-0.3, 0.4 |

-0.3, 0.4 |

-0.3, 0.4 |

|

| Trade-related factors | |||||

| Exporter competitiveness* | Upside | 0.1 | 0.1 | 0.1 | 0.1 |

| Losses from technology-embodied imports* | Downside | -0.1 | -0.1 | -0.1 | -0.1 |

| Labour market scarring | Downside | -0.1 | -0.1 | -0.1 | -0.1 |

| Total trade factors (additive) | -0.2, 0.1 |

-0.2, 0.1 |

-0.2, 0.1 |

-0.2, 0.1 |

|

* indicates risks that are likely to be more prevalent in Scenario 2.

Population growth

Recent population developments and the impact of the announced immigration policies create both upside and downside risks to our population outlook. Compared with the baseline forecast for population growth (Box 2), high population growth increases potential output growth by 0.2 percentage points to 0.3 percentage points over 2025–27 (Table 2), while slow population growth would lower potential output growth by 0.2 percentage points to 0.3 percentage points over the same period.

Adoption of artificial intelligence

The rapid progress of AI technology and the prospect of widespread adoption could also boost productivity. Generative AI is distinct from other general-purpose technologies in its autonomous capability to create new content as well as its relative ease of accessibility. We adapt a framework from Aghion and Bunel (2024) and adjust it for Canadian data (Box 3). We find that mass adoption of generative AI could contribute up to 0.5% to TFP by 2035, which rounds up to an increase in annual growth of about 0.1 percentage points between 2025 and 2028 (Table 2).

Increased competitiveness of Canadian exporters

The threat and imposition of US tariffs on Canadian goods may encourage Canadian exporters to diversify into non-US markets. But entering other markets may be difficult because of the strong foreign competition. However, more exposure to international competition may stimulate Canadian exporters to become more productive. Exporters could achieve these efficiency gains through TFP—for instance, by streamlining processes and promoting better management practices (see, for example, Scur et al. 2024). We estimate that this could add about 0.1 percentage points per year to potential output growth starting in 2025 (Table 2 and Box 4).

Losses from technology-embodied imports

Canadian countermeasures will increase the costs of imports from the United States and will likely encourage Canadian importers to shift to costlier domestic suppliers. Reduced imports would also lessen knowledge and technology transfers embedded in imported goods and equipment, weighing on productivity through lower TFP (see, for example, Madsen 2007). Our assessment suggests that reduced transfers of technology because of reduced imports could remove about 0.1 percentage points per year from potential output growth over the scenario horizon (Table 2 and Box 4).

Persistent rise in the unemployment rate

The slowdown in economic activity due to US tariffs will lower labour demand. As a result, some workers who lose their jobs in industries that rely on trade may remain unemployed. We could see higher unemployment rates, longer periods of unemployment and, over time, depreciation of human capital—making it even more difficult for unemployed people to find a job.

A lengthy trade conflict could amplify these effects, and the transition to the new steady state may coincide with a persistently higher unemployment rate, leading to lower potential output. Some studies find that tariffs could lead to a persistently higher unemployment rate both in theory, for a small open economy (Dinopoulos, Heins and Unel 2024), and empirically, for advanced economies (Furceri et al. 2021).

We use the change in the trend unemployment rate before and after the 2008–09 global financial crisis to benchmark the possible impact on the unemployment rate. While the source of the current shock is different, the comparison is informative because many of the sectors that were significantly affected by the 2008–09 global financial crisis (e.g., agriculture, mining and manufacturing) will likely be the most impacted by the current increase in US tariffs.

To assess the impact of tariffs, we scale the trend unemployment rate response from the global financial crisis so that its corresponding GDP impact matches the magnitude of the expected GDP decline due to the tariffs. We estimate a corresponding, persistent increase in unemployment consistent with a total level impact on potential output of 0.1% to 0.2%.

The time it takes to reach this peak level of unemployment depends on how quickly businesses adjust their production capacity. The full effects could therefore be frontloaded in 2025–26 if businesses adjust quickly, or they could be backloaded in 2026–27 if they adjust more gradually. We therefore assume an impact of as much as -0.1 percentage points on annual growth of potential output growth in any given year, reflecting uncertainty around the pace of increase in the employment rate.

Box 1: Implications of a potential US trade war on potential output

Box 1: Implications of a potential US trade war on potential output

This box discusses the implications of Scenario 2—a permanent increase in tariffs—for trend TFP and potential output. We use a bottom-up approach that combines sector-level exposure to tariffs with anticipated impacts on capital and labour as the economy adjusts to the new trade environment.

In the short term, some businesses will assume the situation is temporary. In this case, they will either:

- reduce their output while maintaining their production potential

- continue to produce at reduced pre-tariff prices and therefore lower profitability

Other businesses will start to adapt to the new reality and will either shrink or fully liquidate their operations. This will lead to widespread layoffs and selling off part or all of their machinery and equipment at liquidation prices. The associated partial loss in the productive use of capital and labour inputs comes from their short-run specificity in production—that is, reallocated equipment and skills tend to be less productive, at least initially.

Our approach quantifies the reductions in capital and labour efficiency that yield the initial decline in measured TFP shown in Chart 1-A.6 We estimate sector-level output losses from higher US tariffs using demand elasticity estimates from the literature and Canada’s input-output structure. We then scale the impacts on capital and labour using each sector’s share in economy-wide capital and labour, as reported by Statistics Canada. Finally, we estimate productivity impacts assuming a 60% efficiency loss for capital (Kermani and Ma 2023) and a 20% initial loss for displaced workers (Birinci, Park and See 2024; Ramey and Shapiro 2001).

We use a global, multi-sector general equilibrium trade model adapted from Baqaee and Farhi (2024) to inform our estimates of the long-term level of TFP under the tariffs. The long-term TFP loss captures the less-efficient reallocation of production across sectors from distortionary tariffs. Our approach suggests that the short-term impact of tariffs on TFP is greater than the long-term impact. Intuitively, the short-term efficiency losses are lessened by the gradual sectoral reallocation of inputs to their most productive use under the new, reduced-trade environment (see also Ferreira and Trejos 2011). These estimates inform our outlook for trend TFP (see Pichette et al. 2015).

In addition to lowering TFP growth, US tariffs are also expected to weigh on productivity through a decline in the aggregate capital stock, amplifying the effects of lower TFP. Two channels affect capital accumulation:

- Reduced US demand for Canadian exports reduces desired capacity, leading to slower investment growth.

- The ongoing uncertainty surrounding US trade policy weakens investor confidence and weighs on investment growth (see Caldara et al. 2020; Handley and Limão 2017). This, in turn, will weaken capital deepening and slow long-term productivity growth.

Chart 1-A: Impact on trend total factor productivity peaks in two years, followed by a partial recovery

Box 2: Immigration and non-permanent residents in Canada

Box 2: Immigration and non-permanent residents in Canada

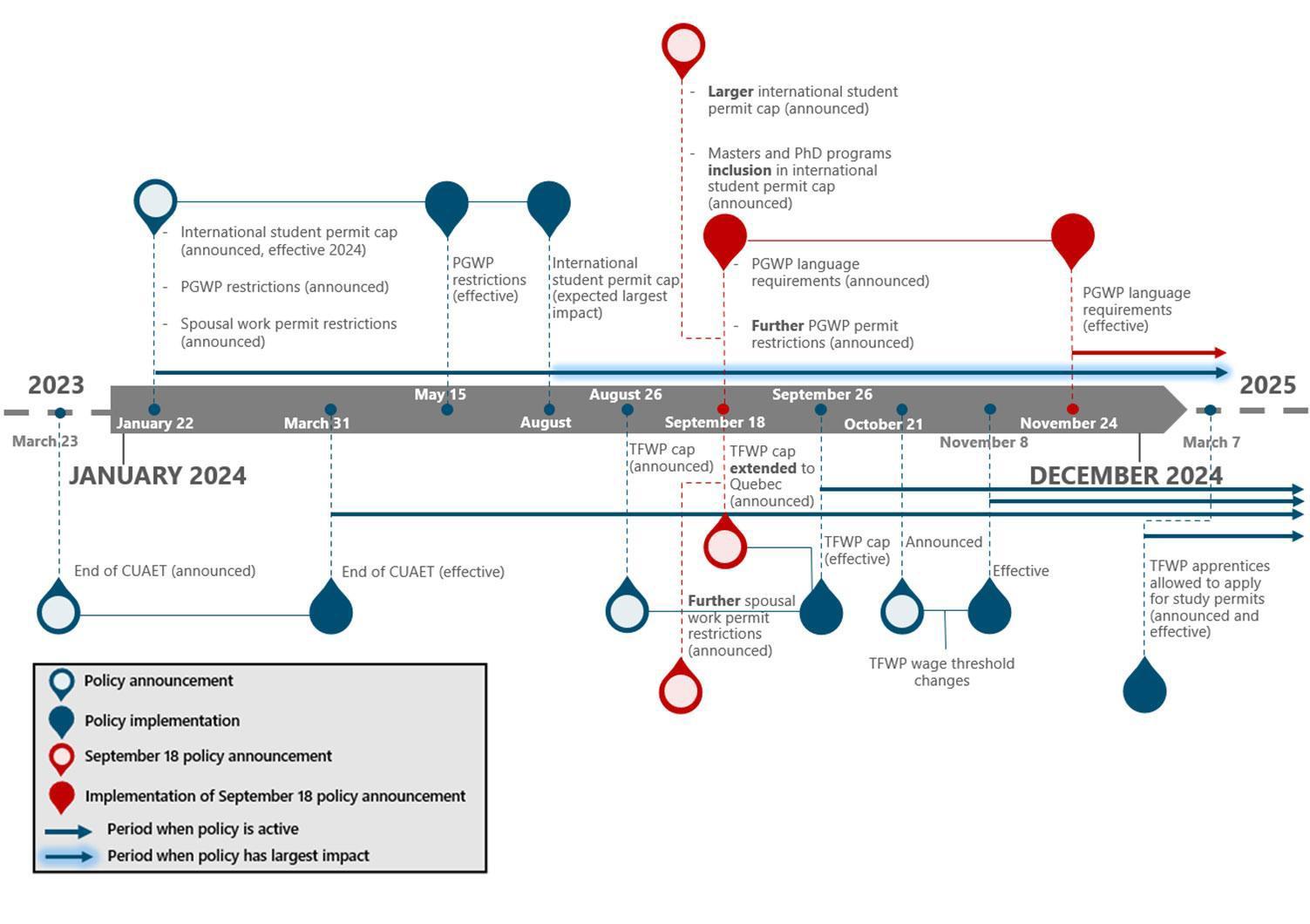

Population growth in Canada has become more uncertain in recent years following the strong increases over 2023–24 related to international migration. Growth will most likely moderate over 2025–27 given the announcements by Immigration, Refugee and Citizenship Canada (IRCC) to restrict foreign temporary work and study permits throughout 2024 and to lower immigration targets. Figure 2-A outlines the timing of the restrictions on flows of temporary residents that have been imposed to date.

Figure 2-A: Timeline of recent federal policies related to temporary resident population

Note: The announcements made on September 18, 2024, due to their significance in program coverage, are distinguished by the colour red. PGWP is the post-graduation work permit. TFWP is temporary foreign worker program. CUAET is the Canada-Ukraine Authorization for Emergency Travel.

In 2024, the assessment incorporated IRCC’s March 21 announcement at face value and therefore assumed the federal government would reduce non-permanent residents (NPRs) to 5% of the population by the end of 2027.7 We have since created a forecast of inflows and outflows of NPRs using data from IRCC and Statistics Canada.

For this forecast, we model both gross inflows and outflows of NPRs:

- To model inflows, we use data on permit inflow for different permit categories and estimate the impact of the various policies in Figure 2-A on each permit category.8

- To model outflows, we account for information on the duration of permits because many permits issued during the large run-up in issuances will expire within the next few years.

However, taken together, these forecasted gross inflows and outflows form our overall forecast for net NPR flows, which is slightly higher than the profile outlined in IRCC’s Immigration Levels Plan.

However, the impacts of the restrictions on temporary resident flows could:

- be smaller or larger than assumed in our baseline scenario

- occur earlier or later than anticipated

We consider both high and low population growth to present upside and downside risks to our outlook for potential output. Our baseline scenario for population growth captures the estimated effects of the policy action.

Specifically, the high population growth scenario assumes:

- permanent resident flows at the upper end of the federal government’s target range

- NPR net flows that incorporate higher inflows of asylum seekers and lower outflows across all permit categories

The low population growth scenario assumes:

- permanent resident flows at the lower end of the range

- a sharper reduction in NPR flows consistent with achieving the government’s target of reducing the non-permanent share of the population to 5% by end of 2026

Box 3: Assessing productivity gains from generative artificial intelligence

Box 3: Assessing productivity gains from generative artificial intelligence

Generative artificial intelligence (GenAI) is a rapidly evolving technology that has potentially wide-reaching implications for productivity. While previous digitalization technologies have typically focused on transforming production processes and business interactions (Faucher and Houle 2023), GenAI is distinct in its ability to generate new content.9 Accessibility and the potential for rapid diffusion makes GenAI the prime candidate for becoming the next general-purpose technology (Bick, Blandin and Deming 2024).

Estimating AI’s impact on productivity is inherently challenging because of the relative infancy of the technology and the scarcity of data. We overcome these challenges by building on existing estimates from the literature.

Our approach follows Aghion and Bunel (2024) and models AI’s expected contribution to annual growth of total factor productivity (TFP) as a function of four factors:

- the share of gross domestic product (GDP) generated by tasks affected by GenAI in advanced economies

- the share of those tasks where GenAI use is profitable

- average cost savings from GenAI across those tasks10

- the share of the labour force exposed to GenAI given differential occupational task compositions, which we reconstruct and estimate by using data on the Canadian labour force11

We produce two exposure measures:

- a lower bound, which accounts solely for occupational tasks expected to have high potential exposure

- an upper bound, which incorporates tasks with lower potential exposure levels

Using these measures, we then obtain a range of estimates of TFP impacts (Chart 3-A).

Chart 3-A: Impact of generative artificial intelligence varies across sectors

We find positive effects to TFP of the total economy ranging from 0.3% to 0.5% over the next 10 years. As with other general-purpose technologies, GenAI is predicted to have a pervasive impact across all sectors, with our analysis predicting a minimum boost of 0.3% by 2035.

TFP gains are most pronounced in service-based sectors (e.g., finance and insurance and professional, scientific and technical services). Many tasks in these sectors are highly structured and information-based, making them easier to automate or augment with GenAI. Modest gains are expected in goods-producing sectors, such as manufacturing and construction. This is because occupational composition is more weighted toward physical and capital-intensive tasks, which are less likely to benefit from GenAI. Finally, the mining and utilities sectors show relatively high potential to benefit from GenAI, possibly due to the importance of monitoring and data-intensive processes involved in operations.

Box 4: Assessing the impact of tariffs on total factor productivity of exporters and importers

Box 4: Assessing the impact of tariffs on total factor productivity of exporters and importers

Increased competitiveness of Canadian exporters

Canadian exporters could achieve productivity gains by seeking to sell their products to non-US markets in response to US tariffs. Some empirical evidence suggests that Canadian exporters are more productive than their non-exporting counterparts but not as productive as foreign multinational corporations operating in Canada. Therefore, for Canadian exporters to enter other export markets, their productivity would have to catch up with that of international competitors. They could achieve these efficiency gains through total factor productivity (TFP) by, for example, streamlining production processes and by adopting better management practices (see, for example, Scur et al. 2024).

To quantify these productivity gains, we rely on estimates from the literature: Canadian exporters and foreign multinationals in Canada are about 13% and 20% more productive than Canadian non-exporters, respectively (Baldwin and Yan 2017; Tang and Wang 2020).12 We assume that Canadian exporters will close two-thirds of the gap over the next three years. This could boost trend TFP by about 0.1 percentage points each year.13

Losses from technology-embodied imports

As US goods become less competitive, Canadian businesses need to turn to domestic or other foreign suppliers that may be costlier or provide imperfect substitutes. Studies show that technology and knowledge—embedded in imported goods—transfer across borders through trade (for example, Madsen 2007). The trade conflict would weaken this import channel, reducing TFP growth as Canadian countermeasures lower imports from the United States to Canada.

To quantify this channel, we estimate the relationship between TFP growth and imports growth over history using sector-level data.14 To estimate the impact after 2024, we then adjust sectoral TFP growth downward given the size of the decline in imports in Scenario 2 and aggregate using a Domar aggregation. We find, overall, that trend TFP growth could be about 0.1 percentage points lower each year from 2025 to 2028.

Appendix

Table A-1: Comparison of Canadian potential output estimates relative to April 2024

| Scenario | Annual growth | Trend labour input growth | Trend labour productivity growth | Revisions to the level (percent) | |

|---|---|---|---|---|---|

| 2024 | 1 | 2.9 (2.5) | 3.3 (3.0) | -0.5 (-0.5) | 1.0 |

| 2 | 2.9 (2.5) | 3.3 (3.0) | -0.5 (-0.5) | 1.0 | |

| 2025 | 1 | 1.8 (1.7) | 0.7 (0.9) | 1.2 (0.8) | 1.1 |

| 2 | 1.2 (1.7) | 0.7 (0.9) | 0.5 (0.8) | 0.5 | |

| 2026 | 1 | 1.3 (1.5) | 0.2 (0.6) | 1.2 (0.9) | 0.9 |

| 2 | 0.4 (1.5) | 0.2 (0.6) | 0.2 (0.9) | -0.7 | |

| 2027 | 1 | 1.4 (1.7) | 0.2 (0.6) | 1.2 (1.0) | 0.6 |

| 2 | 1.0 (1.7) | 0.2 (0.6) | 0.8 (1.0) | -1.3 | |

| 2028 | 1 | 1.7 | 0.6 | 1.1 | |

| 2 | 1.6 | 0.6 | 1.0 |

References

Acemoglu, D. 2024. “The Simple Macroeconomics of AI.” National Bureau of Economic Research Working Paper No. 32487.

Aghion, P. and S. Bunel. 2024. “AI and Growth: Where Do We Stand?” Federal Reserve Bank of San Francisco Staff Note.

Baldwin, J. and B. Yan. 2017. “Trade and Productivity: Insights from Canadian Firm-Level Data.” In Redesigning Canadian Trade Policies for New Global Realities, edited by S. Tapp, A. Van Assche and R. Wolfe. Institute for Research on Public Policy.

Baqaee, D. R. and E. Farhi. 2024. “Networks, Barriers, and Trade.” Econometrica 92(2): 505–541.

Barnett, R. 2007. “Trend Labour Supply in Canada: Implications of Demographic Shifts and the Increasing Labour Force Attachment of Women.” Bank of Canada Review (Summer): 5–18.

Bick, A., A. Blandin and D. Deming. 2024. “The Rapid Adoption of Generative AI.” Blog. Federal Reserve Bank of St. Louis, September 23.

Birinci, S., Y. Park and K. See 2024. “The Heterogeneous Impacts of Job Displacement: Evidence from Canadian Job Separation Records.” Federal Reserve Bank of St. Louis Working Paper No. 2023-022.

Bloom N., M. Floetotto, N. Jaimovich, I. Saorta-Eksten and S. Terry. 2018. “Really Uncertain Business Cycles.” Econometrica 86(3): 1031–1065.

Caldara, D., M. Iacoviello, P. Molligo, A. Prestipino and A. Raffo. 2020. “The Economic Effects of Trade Policy Uncertainty.” Journal of Monetary Economics 109: 38–59.

Champagne, J., E. Ens, X. Guo, O. Kostyshyna, A. Lam, C. Luu, S. Miller, P. Sabourin, J. Slive, T. Taskin, J. Trujillo and S. L. Wee. 2023. “Assessing the Effects of Higher Immigration on the Canadian Economy and Inflation.” Bank of Canada Staff Analytical Note No. 2023-17.

Devakos, T., C. Hajzler, S. Houle, C. Johnston, A. Poulin-Moore, R. Rautu and T. Taskin. 2024. “Potential Output in Canada: 2024 Assessment.” Bank of Canada Staff Analytical Note No. 2024-11.

Dinopoulos, E., G. Heins, and B. Unel. 2024. “Tariff Wars, Unemployment, and Top Incomes.” Journal of Monetary Economics 148: 103616.

Faucher, G. and S. Houle. 2023. “Digitalization: Definition and Measurement.” Bank of Canada Staff Discussion Paper No. 2023-20.

Ferreira, P. C. and A. Trejos. 2011. “Gains from Trade and Measured Total Factor Productivity.” Review of Economic Dynamics 14(3): 496–510.

Furceri, D., S. A. Hannan, J. D. Ostry and A. K. Rose, 2021. “The Macroeconomy After Tariffs.” World Bank Policy Research Working Paper 9854.

Handley, K. and N. Limão. 2017. “Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the United States.” American Economic Review 107(9): 2731–2783.

Kermani, A. and Y. Ma. 2023. “Asset Specificity of Nonfinancial Firms.” The Quarterly Journal of Economics 138(1): 205–264.

Madsen, J. B. 2007. “Technology Spillover Through Trade and TFP Convergence: 135 Years of Evidence for the OECD Countries.” Journal of International Economics 72(2): 464–480.

Mollins, J. and T. Taskin. 2023. “Digitalization: Productivity.” Bank of Canada Staff Discussion Paper No. 2023-17.

Pichette, L., P. St-Amant, B. Tomlin and K. Anoma. 2015. “Measuring Potential Output at the Bank of Canada: The Extended Multivariate Filter and the Integrated Framework.” Bank of Canada Staff Discussion Paper No. 2015-1.

Ramey, V. A. and M. D. Shapiro. 2001. “Displaced Capital: A Study of Aerospace Plant Closings.” Journal of Political Economy 109(5): 958–992.

Schmitz Jr., J. A. 2005. “What Determines Productivity? Lessons from the Dramatic Recovery of the U.S. and Canadian Iron Ore Industries Following Their Early 1980s Crisis.” Journal of Political Economy 113(3): 582–625.

Scur, D., S. Ohlmacher, J. van Reenen, M. Bennedsen, N. Bloom, A. Choudhary, L. Foster, J. Groenewegen, A. Grover, S. Hardeman, L. Lacovone, R. Kambayashi, M.-C. Liable, R. Lemos, H. Li, A. Linarello, M. Maliranta, D. Medvedev, C. Meng, J. M. Touya, N. Mandirola, R. Ohlsbom, A. Ohyama, M. Patnaik, M. Pereira-López, R. Sadun, T. Sengra, F. Qian and F. Zimmermann. 2004. “The International Empirics of Management.” This Week in PNAS 121(45).

Tang, J. and W. Wang. 2020. “Why Are Multinationals More Productive than Non-multinationals? Evidence from Canada.” Statistics Canada, Analytical Studies Branch Research Paper Series, No. 445.

World Economic Forum. 2023. Jobs of Tomorrow: Large Language Models and Jobs. World Economic Forum White Paper, September.

Endnotes

- 1. The April 2025 Monetary Policy Report presents the full list of key assumptions.[←]

- 2. The positive historical GDP revisions are associated with higher GDP growth in 2022–24, which impact estimated trend TFP growth in the same direction. The update for flows and stocks is associated with a relatively weak TFP estimate in 2023, lowering trend TFP growth in both 2023 and 2024.[←]

- 3. See Barnett (2007) for a detailed description of the cohort-based model of TLI.[←]

- 4. On October 24 the government unveiled its 2025–27 Immigration Levels Plan. See the Government of Canada’s 2024–2026 Immigration Levels Plan and 2025–2027 Immigration Levels Plan for more details on the immigration target changes.[←]

- 5. Capital deepening is growth in aggregate capital stock per trend hour worked, the latter is measured through TLI. It is therefore positively related to capital accumulation (i.e., fixed asset investment) and negatively related to TLI.[←]

- 6. This dynamic assumes businesses reduce their capacity in various ways, reflecting differences in competitiveness, cash flow and perceptions of how long-lasting the tariffs will be.[←]

- 7. “Speaking notes for the Honourable Marc Miller, Minister of Immigration, Refugees and Citizenship: Announcement related to Temporary Residents,” Immigration, Refugees and Citizenship Canada, March 21, 2024. The speech did not specify a target date, so the previous assessment assumed a deadline of 2027. The Immigration Levels Plan set 2026 as the target deadline.[←]

- 8. Note that we calibrate this to Statistics Canada’s definition of NPRs, which accounts for people holding multiple permits, deaths and permit expiries.[←]

- 9. See Mollins and Taskin (2023) on the productivity implications of digitalization.[←]

- 10. The debate surrounding the total economic impact of GenAI is influenced largely by varying estimates of cost savings. Aghion and Bunel (2024) address this by taking an average of benchmark empirical studies. However, this estimate may be considered overly optimistic or misrepresentative because the studies are conducted at a granular level within specific occupations rather than being broadly representative across sectors.[←]

- 11. We use the same lower-bound parameter assumptions for the first three factors as these estimates are not country-specific (e.g., estimates for advanced economies). This is consistent with the approach by Aghion and Bunel (2024), who use US-specific estimates (Acemoglu 2024) for the fourth factor. To adapt the last factor to Canada, we map occupational AI task exposure scores from the World Economic Forum (2023) based on US O*NET classifications to Canadian National Occupation Classification codes. Then, using microdata from the Canadian Labour Force Survey, we calculate occupational compositions within sectors and use these to estimate an aggregate index weighted by occupational exposure.[←]

- 12. Estimates from these studies are in terms of labour productivity, but we assume these productivity gains occur through TFP. Moreover, estimates from Baldwin and Yan (2017) are for businesses in the manufacturing sector, but we assume they apply more broadly across sectors.[←]

- 13. The timing of possible gains is uncertain, and little evidence guides this judgment. Past experience is also scarce, but Schmitz (2005) documents a rapid increase of productivity in the Canadian iron ore industry within five years after a sharp increase in competition in the steel market in the early 1980s.[←]

- 14. We use official TFP data from Statistics Canada (Table 36-10-0217-01), and we extract imports data from the OECD Inter-Country Input-Output tables. The panel regression includes lags of import growth that allow us to identify the dynamic of the adjustment by sector.[←]

Acknowledgements

We acknowledge the contributions of Adrienne Gagnon, Gabriela Galassi, Olena Senyuta and Youngmin Park to the analysis presented in this note. We thank Marc-André Gosselin and Alexander Ueberfeldt for their comments and suggestions. We also thank Colette Stoeber and Nicole van de Wolfshaar for their editorial assistance. Finally, we thank Marie-Lou Lachance and Patricia Marando for their help in translating this note into French.

Disclaimer

Bank of Canada staff analytical notes are short articles that focus on topical issues relevant to the current economic and financial context, produced independently from the Bank’s Governing Council. This work may support or challenge prevailing policy orthodoxy. Therefore, the views expressed in this note are solely those of the authors and may differ from official Bank of Canada views. No responsibility for them should be attributed to the Bank.

DOI: https://doi.org/10.34989/san-2025-14