Motivation and objectives

The Bank of Canada regularly reviews its Framework for Market Operations and Liquidity Provision to ensure it remains in line with the evolution of the Canadian financial system. Based on a recent review, the Bank plans to introduce a new bilateral liquidity facility, the Standing Term Liquidity Facility (STLF). While the Bank’s current framework has been effective in achieving the Bank’s objectives, the addition of the STLF will further strengthen the overall framework in response to ongoing changes in the financial system. For instance, greater interconnectedness of the financial system is beneficial in some respects, but it can increase the risk that idiosyncratic liquidity shocks affecting one institution could spread to other parts of the financial system. Such liquidity shocks can stem from various sources, including operational incidents such as cyber attacks, system failures and natural disasters. The addition of the STLF to the Bank’s liquidity tool kit marks another step in the Bank’s efforts to enhance the resilience of the Canadian financial system.

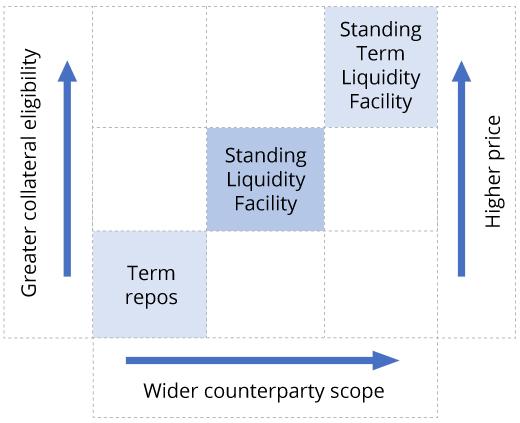

The STLF is intended to provide greater confidence that, where the Bank of Canada has no concerns about its soundness, a financial institution facing an idiosyncratic liquidity stress will have access to central bank liquidity on terms that are known in advance. The STLF will provide access to a broader set of eligible counterparties against a broader set of collateral at a higher price relative to routine term repo operations and the Standing Liquidity Facility (SLF). Figure 1 summarizes the STLF’s positioning within the Bank’s framework for liquidity provision along three dimensions: counterparty, collateral and price. This new facility will provide the Bank with a larger menu of complementary tools that support graduated and well-designed interventions, consistent with the Bank’s previously established principles for liquidity intervention. As with other Bank liquidity tools, provision of liquidity under the STLF will be at the sole discretion of the Bank of Canada.

In the coming weeks, the Bank will conduct targeted consultations with interested stakeholders to solicit comments on the proposed design of the STLF.

Figure 1: Graduated nature of the Bank of Canada's liquidity provision tool kit

Proposed design of the Standing Term Liquidity Facility

Eligible counterparties

For a financial institution to be eligible for the STLF:

- It must be a federally or provincially prudentially regulated member of Payments Canada.

- In the judgment of the Bank of Canada, there is no concern about the soundness of the financial institution.

This scope would provide the Bank with the flexibility to lend to a broad range of prudentially regulated financial institutions while respecting the Bank of Canada Act, which gives the Bank the power to make loans or advances to members of Payments Canada.

The Bank would need sufficient and timely information about the financial institution to make an informed judgment about any possible soundness concerns.

Collateral

Eligible STLF collateral would include:

- any marketable security eligible for the SLF,

- Canadian-dollar non-mortgage loans made to Canadian residents,1

- insured Canadian-dollar residential mortgage loans to Canadian residents, and

- uninsured Canadian-dollar residential mortgage loans to Canadian residents with a low loan-to-value (LTV) ratio.

Under the Bank of Canada Act, all lending by the Bank must be secured by collateral, and an appropriate margin (haircut) is applied to reflect various risk factors.

The inclusion of mortgage loans in the list of eligible collateral provides additional flexibility and borrowing capacity. In line with the objectives of the STLF, eligible uninsured mortgages would be limited to those with lower LTV ratios.

Term to maturity

The term would be 30 days, renewable at the Bank of Canada’s discretion.

A one-month term is long enough to send a confidence-enhancing signal to markets. Term loans would also give the borrower sufficient certainty and liquidity insurance to avoid taking actions that could harm both it and the broader financial system (such as selling off assets in a fire sale, suddenly withdrawing liquidity lines or drastically reducing household and business lending). At the same time, a one-month term would not reduce the borrower’s incentive to arrange for longer-term market sources of funding and a return to normal funding conditions.

Price

Pricing would follow a two-tier structure, where institutions borrowing against SLF-eligible marketable collateral would be charged an interest rate equal to the one-month overnight index swap (OIS) rate plus a spread. Borrowings collateralized by other eligible (non-marketable) collateral would be subject to an interest rate equal to the one-month OIS rate plus a spread larger than that for marketable collateral. In all cases, the minimum interest rate would be the Bank rate.2

The intent is to set the price such that it is at a premium to market rates during normal times, but affordable during idiosyncratic episodes of liquidity stress when market funding sources become more costly. The two-tier structure is intended to avoid undue complexity while still reflecting the graduated design of the STLF: the borrower would pay a higher price to borrow against less-liquid (i.e., non-marketable) collateral.

The precise calibration of the proposed pricing structure will be informed by targeted consultations. These will include discussions with market stakeholders on the pricing of private sources of funding. The calibration of pricing for the STLF will also take into account pricing for the Bank’s existing liquidity tools and prices charged by other central banks for their liquidity facilities.

Currency

Liquidity would be provided in Canadian dollars only. Financial institutions would be responsible for ensuring they have reliable arrangements for liquidity support in foreign currencies.

Since the STLF is meant to be used in the early stages of stress, institutions are expected to be able to obtain foreign currencies, as needed, by exchanging Canadian dollars in the foreign exchange market.

Public disclosure

The Bank of Canada would disclose an outstanding STLF advance in its periodic financial reporting.

Outstanding STLF advances will be visible through the Bank’s weekly, monthly, quarterly and annual publications under the same “Advances” line item as SLF advances. The Bank does not disclose the identity of borrowing institutions.

Next steps

The targeted industry consultation is expected to be completed before the end of 2019. The Bank will consider the comments received and expects to publish a formal policy for the STLF on its website in the first half of 2020. Beyond this, work will continue to operationalize the facility as soon as possible.