December 9, 2021

Keeping our eyes on inflation

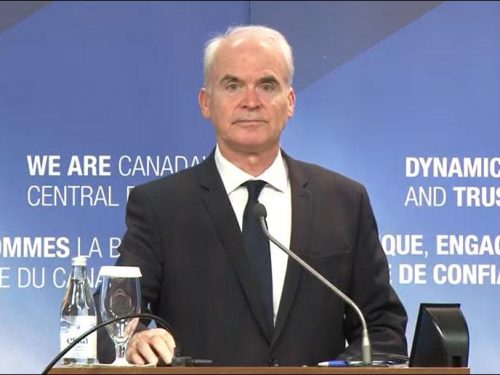

Deputy Governor Toni Gravelle talks about the Bank of Canada’s decision yesterday to leave the policy rate unchanged. He explains the link between supply bottlenecks and high inflation and why the Bank thinks both will ease over time.